How Independent Investment Advisor copyright can Save You Time, Stress, and Money.

Wiki Article

Not known Incorrect Statements About Retirement Planning copyright

Table of ContentsIndicators on Tax Planning copyright You Should KnowA Biased View of Financial Advisor Victoria BcWhat Does Financial Advisor Victoria Bc Do?A Biased View of Retirement Planning copyrightIa Wealth Management Things To Know Before You BuySome Ideas on Private Wealth Management copyright You Need To Know

“If you were to purchase something, say a tv or a computer, you'd need to know the specifications of itwhat tend to be their components and what it can do,” Purda explains. “You can think about purchasing economic guidance and assistance in the same way. People must know what they are getting.” With monetary information, it is vital that you understand that the merchandise isn’t securities, stocks or other investments.it is such things as budgeting, planning your retirement or paying down debt. And like getting a personal computer from a dependable organization, customers want to know these are generally buying economic advice from a reliable pro. Certainly Purda and Ashworth’s most fascinating conclusions is about the costs that financial coordinators demand their clients.

This conducted true regardless the cost structurehourly, commission, assets under administration or flat rate (when you look at the study, the buck property value costs was actually the exact same in each situation). “It however boils down to the worth idea and uncertainty about consumers’ part which they don’t understand what they're getting into change for those charges,” claims Purda.

The Buzz on Private Wealth Management copyright

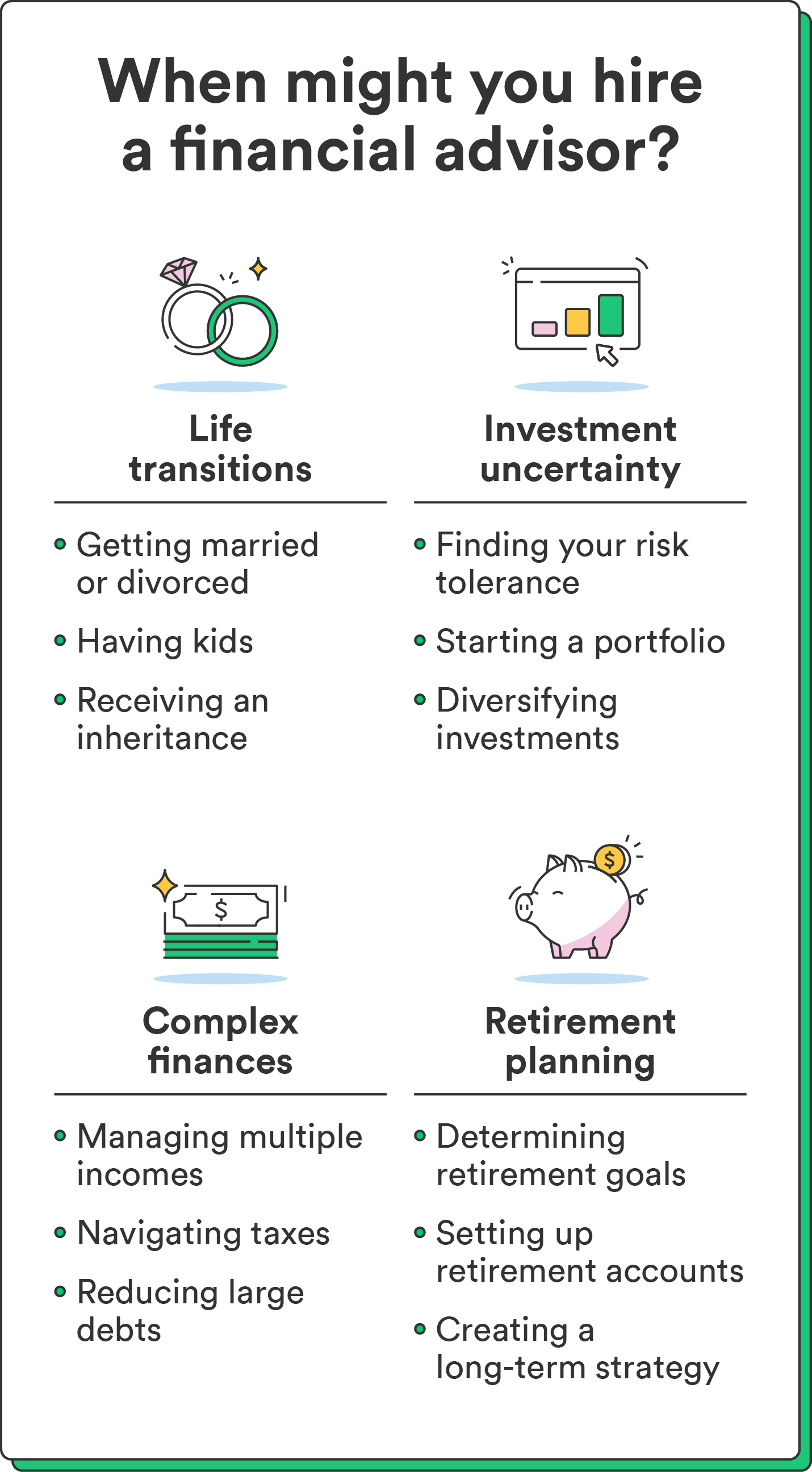

Tune in to this article whenever you notice the term economic expert, just what comes to mind? Many people contemplate a professional who is able to provide them with economic information, specially when it comes to investing. That’s a fantastic starting point, although it doesn’t color the complete photo. Not really close! Economic advisors will individuals with a lot of different cash goals too.

A monetary specialist assists you to develop wealth and protect it for any continuous. They can approximate your own future financial requirements and program how to stretch your your retirement savings. They could in addition help you on when to begin making use of personal safety and using money inside retirement reports in order to avoid any unpleasant charges.

The Basic Principles Of Ia Wealth Management

They could make it easier to determine what shared funds tend to be best for your needs and show you how to handle making the absolute most of your own opportunities. They may be able additionally support comprehend the risks and exactly what you’ll have to do to produce your goals. An experienced financial investment expert will also help you stay on the roller coaster of investingeven once opportunities simply take a dive.

They are able to provide direction you will need to produce a strategy to help you ensure that your wishes are executed. While can’t put a cost tag on the reassurance that include that. Based on a recent study, the common 65-year-old few in 2022 needs to have about $315,000 conserved to pay for medical care costs in retirement.

About Ia Wealth Management

Now that we’ve gone over what financial advisors do, let’s dig to the numerous kinds. Here’s a good guideline: All economic planners are monetary analysts, not all analysts are planners - https://www.domestika.org/en/carlosprycev8x5j2. An economic coordinator concentrates on helping folks generate intentions to attain long-term goalsthings like starting a college fund or saving for a down payment on a home

Exactly how do you understand which financial specialist suits you - https://pubhtml5.com/homepage/wrtus/? Below are a few steps you can take to make certain you’re hiring just the right person. What do you do if you have two bad choices to pick? Effortless! Discover more solutions. The greater number of possibilities you have got, the much more likely you might be to produce an excellent choice

Things about Private Wealth Management copyright

All of our Intelligent, Vestor system causes it to be easy for you by showing you around five economic experts who can serve you. The best part is, it’s completely free attain associated with an advisor! And don’t forget to get to the interview prepared with a list of questions to inquire of so you can determine if they’re a good fit.But tune in, even though a specialist is actually smarter compared to the ordinary bear does not let them have the right to let you know what direction to go. Occasionally, advisors are full of on their own simply because they have significantly more degrees than a thermometer. If an advisor starts talking-down for your requirements, it is for you personally to demonstrate to them the entranceway.

Keep in mind that! It’s essential along with your economic advisor (the person who it ultimately ends up becoming) take equivalent page. You want a specialist having a long-term investing strategysomeone who’ll convince one to keep trading consistently perhaps the market is upwards or down. ia wealth management. You don’t want to deal with an individual who pushes one purchase something’s too dangerous or you are not comfortable with

Financial Advisor Victoria Bc Can Be Fun For Everyone

That combine will give you the variation you need to effectively invest for long haul. Just like you study financial experts, you’ll most likely come upon the phrase fiduciary obligation. All of this suggests is actually any advisor you employ must work in a fashion that benefits their particular customer and not their own self-interest.Report this wiki page